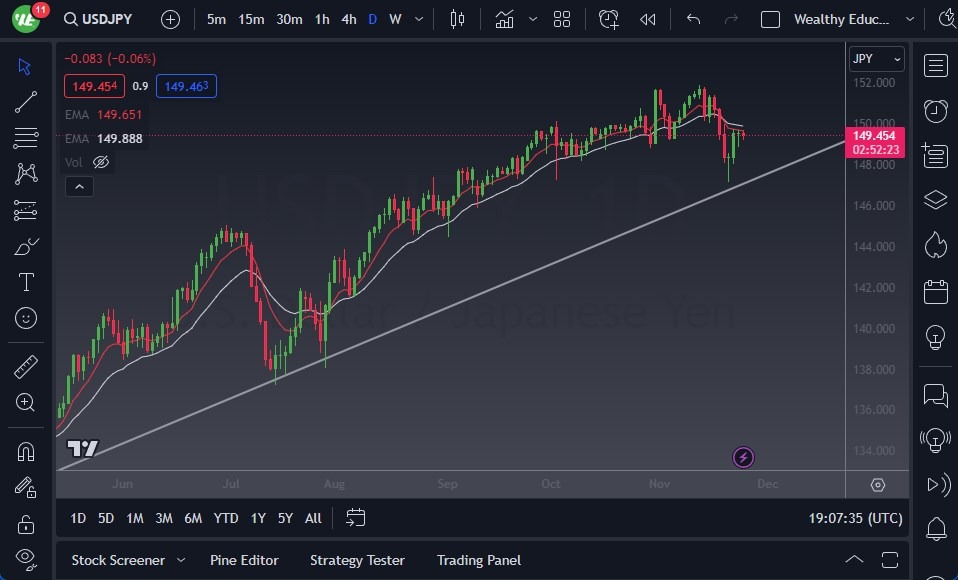

The US dollar fell early in Friday’s session, but significant support near the 50-day moving average indicated a possible reversal. The market is challenging and preparing to breach the 150 yen level. It should be noted that the trading environment has been quiet over the past two days, affected by the Thanksgiving holiday and generally lower Friday trading in the US. However, the 147.80 yen level emerged as an important support point, fueling the dollar’s recovery.

Our recommended forex brokers in the region

Observing the broader currency markets, it is clear that the Japanese yen remains weak relative to most of the currencies it is rated against. This trend is expected to continue, before the market returns to previous highs, exhibiting noisy or “noisy” behavior. Despite the recent decline in interest rates, the interest rate differential favors the US dollar, reducing the attractiveness of the Japanese yen, especially against the US dollar, which has safe-haven currency status.

The market is expected to show significant volatility, but there is a strong undercurrent of buyers keen to take advantage of the perceived value of the US dollar at a lower rate. Any general strength in the US dollar against other currencies will further benefit the USD/JPY pair. Hence, the value of this pair is expected to rise significantly.

A break above the ¥152 level would pave the way for the next target at the ¥155 level, and while USD/JPY’s rise may not be as fast as that of other currencies, the overall trend is undeniably bullish. The consistent pattern of buyers during the pullback reinforces the idea that investing in this pair is a smart strategy.

Ultimately, the USD/JPY path is characterized by a stubborn pullback and potential for upward momentum. Along with the 50-day moving average and support at the 147.80 yen level, a positive interest rate differential and the dollar’s safe haven, all contribute to a positive outlook for USD/JPY. Investors and traders are likely to find opportunities in the volatility of this pair, with a general trend towards higher values. When the market goes through its ups and downs, a “buy tips” strategy looks especially smart to take advantage of the strength of the US dollar against the Japanese yen and the general weakness in Japan.

“Award-winning beer geek. Extreme coffeeaholic. Introvert. Avid travel specialist. Hipster-friendly communicator.”