A few hours separate us from the start of the upcoming OPEC + meeting; In preparation for settling one of the most contentious files, this one: how the coalition is tightening its grip on oil markets amid some moves to rein in affairs in oil markets amid falling crude prices. .

Today, Sunday, June 4 (2023), as global oil production leaders prepare to meet, several scenarios are being raised for a possible escape from the current oil market crisis. including approving additional production cuts or officially replacing existing voluntary cuts by some coalition countries and any new ideas.

Yesterday, Saturday, the Alliance’s Ministerial Oversight Committee met ahead of today’s OPEC+ meeting with the aim of charting the course of action expected from the Alliance to correct shaky market conditions. Discussions are underway to cut oil production by a million barrels per day, according to a company statement. Reuters.

The special energy platform reviews the 4 most important scenarios at the table of the coalition ministers, which will lead the meeting of Saudi Energy Minister Prince Abdulaziz bin Salman and Russian Deputy Prime Minister Alexander Novak.

Premiere: The Official Extra Cut

While participating in the Qatar Economic Forum, Saudi Energy Minister Prince Abdulaziz bin Salman issued a warning to traders and manipulators in the oil markets. Alliance meeting.

Sources raised the possibility that the OPEC+ meeting would come out with an important and direct decision, an agreement to reduce crude oil production by one million barrels, in addition to the official cut agreed by the coalition in October 2022. It will be implemented in November and will continue till the end of December 2023.

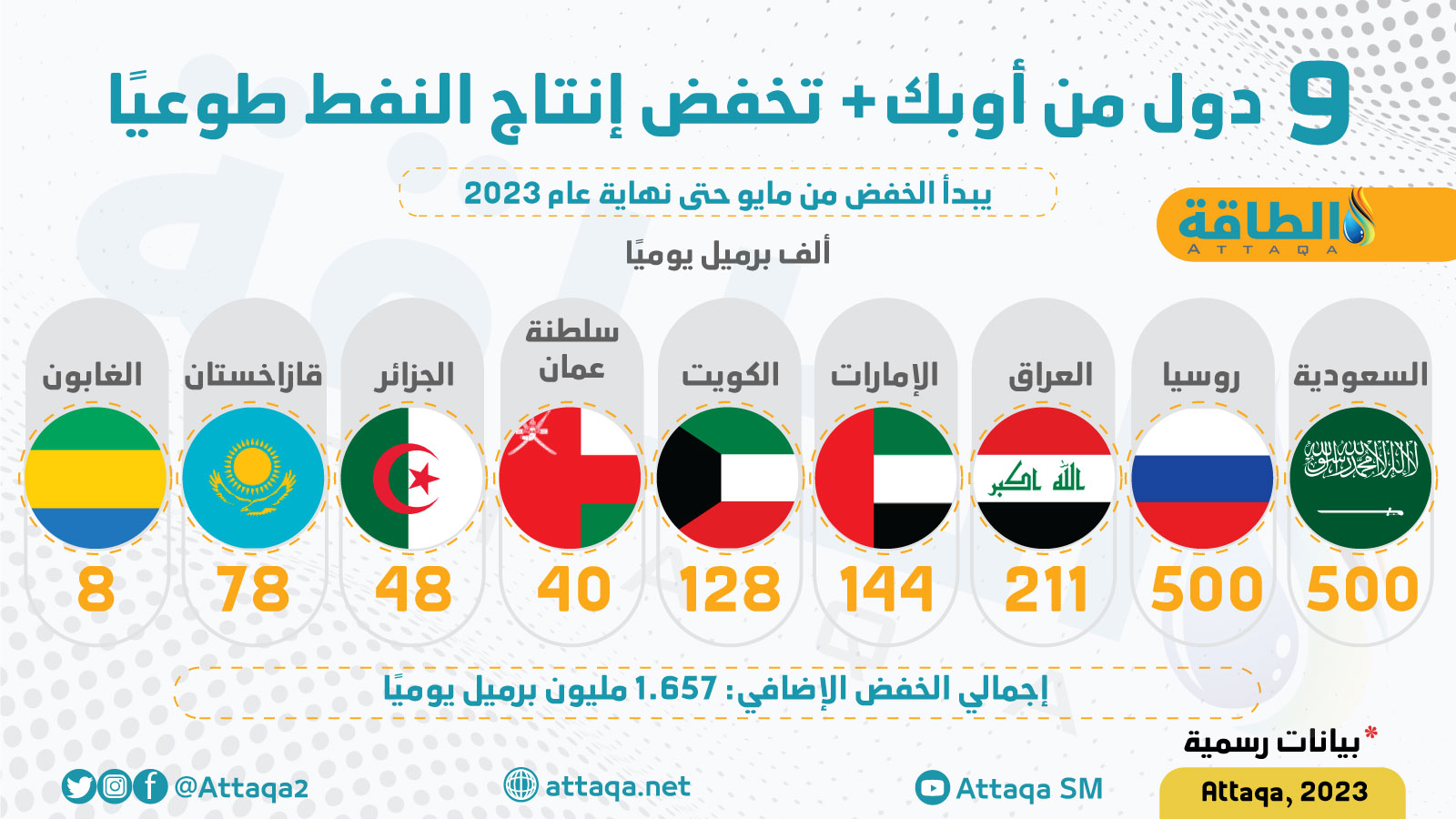

If the coalition agrees to this cut, the total reduction in OPEC+ production will be an official 3 million barrels per day, plus the 1.66 million barrels that some countries agreed to cut on a voluntary basis, totaling 4.66 million barrels from official and voluntary production cuts; According to statistics monitored by the Special Energy Platform, this is 4.5% of global production.

Informed sources believe crude oil prices fell to around $70 a barrel during last week’s trading as one of the most important reasons behind the idea of further production cuts, especially after the US debt ceiling deal, Reuters reported, as crude oil posted weekly losses.

This trend was supported by Bob McNally, president of the US company Rapidan Energy, who, in a statement to the Special Energy Forum, said that OPEC + ministers want to extend their agreement and allow production cuts to take effect this month. , but if oil prices fall, another production cut is likely. Oil rose further over the weekend (week ending Friday, June 2).

At the same time, Chief Adviser on Foreign Policy and Energy Geopolitics, Omod Shukri, considered that if oil prices drop to $75 per barrel, it is possible to trigger discussions within OPEC + on adjusting production levels to manage the market. , the Alliance has historical decisions to reduce or increase production in response to a number of factors, including market conditions and supply and demand dynamics, in particular.

Second scenario: Making voluntary cuts official

According to experts, among the scenarios on the agenda of the OPEC + meeting, with the aim of assessing the market situation and limiting the rules and supply levels, some coalition countries will convert into official cuts in production. and request. To propagate the idea of proportionally redistributing allocations to each country that supports the idea of lowering the production ceiling.

The following chart, prepared by the Special Energy Platform, shows the extent of voluntary reductions by the 9 countries in the OPEC+ alliance:

Paul Hygan, editor-in-chief of the “Petroleum Economist” site, said that it is clear that there is not much desire among the ministers hosting the OPEC + meeting to cut crude oil production more than it has already been cut. After the last short period after the last round of cuts. , illustrates the potential of turning voluntary cuts into a formal agreement to improve credibility and accountability.

Third scenario: A new voluntary cut

Experts expected an agreement on a new voluntary reduction in crude oil production, led by Saudi Arabia, at the next OPEC+ meeting, but the move would not be isolated. That would require one of two things for a vote: repealing or revising the previous voluntary cuts, or converting the voluntary cuts that took effect last May into official cuts, and then agreement among some of the coalition’s member states on a new voluntary cut.

In both cases, a specific action is required that would cancel or formalize the previous decision voluntarily taken by the 9 OPEC+ countries.

In this context, Vandana Hari, founder of the “Vanda Intelligence” Center, hopes that the coalition may formalize voluntary cuts in its next meeting.

When asked about the possibility of Saudi Arabia pulling off a surprise by approving a new voluntary cut, Vandana said in a statement to the energy platform: “It is difficult to see the kingdom providing additional voluntary cuts on its own, especially when Russia is providing half of the cut, which it has promised to be 500,000 barrels.

Fourth scenario: maintenance of the status quo

Although Vandana Hari has hinted at the possibility of an agreement to convert the voluntary cut into a formal one; Most of the vision they had was to stabilize the current situation and give the last result along with the previous results an opportunity to better influence the markets.

Also, in the statements of the Special Energy Platform, OPEC + said that it always gives time to achieve full compliance and to monitor the impact of production cuts on the real market, before taking other measures, and beyond that; Taking into account the risk of oil market surprises; The alliance has previously sprung similar surprises in recent years.

The trend was supported by Swiss commodity analyst Giovanni Stanovo, who said OPEC+ would continue to maintain its cautious stance with the aim of maintaining the balance of the oil market. .

Voluntary production cuts announced last April by some alliance countries, which began implementation in May, needed time to affect market balance, Stanovo explained in reports to the Special Energy Platform.

Related topics..

Also read this..

“Award-winning beer geek. Extreme coffeeaholic. Introvert. Avid travel specialist. Hipster-friendly communicator.”