Today, with markets closed for the Easter holiday, employment figures for March were released in the US.

How were the results?

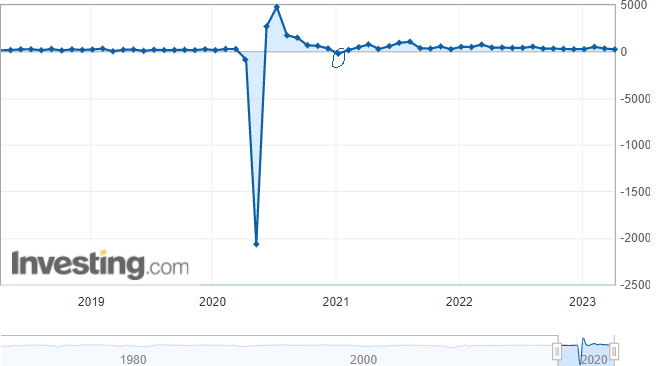

increased. This is the lowest performance on a monthly basis since January 2021.

It rose to 3.6% in February after falling to 3.4% in January, the lowest level in nearly 54 years. In March, the rate fell to 3.5%. There was no significant change in the number of unemployed at 5.8 million.

It was up 0.3% on a monthly basis. On an annual basis, the rate fell to 4.2%. The annual decline was clear compared to 5.6% in March 2022, but a reduction in working hours was reported to have been effective in lowering the rate last month.

How were the employment numbers in the first quarter of the year?

Employment figures for January were revised up by 32K and the number of jobs fell from 504K to 472K. On the other hand, data for February was revised up by 15 to 326 thousand. Thus, there was a 17 thousand drop in the first two months of data. The March figure already represents the lowest increase in 26 months.

The labor force participation rate has reached its highest level since April 2020 at 62.6%.

The numbers clearly show a slowdown in the U.S. employment sector, which is actually expected from interest rate hikes, but it falls short of distracting the Federal Reserve.

Of course, inflation is the Federal Reserve’s main metric, but so is the extent of damage to the economy to reduce inflation. Expectations of a soft landing were optimistic until the banking crisis, and now there is entrenched inflation in addition to the problems of the banking sector, which poses a serious risk of the economy entering recession.

A fall in energy prices in February had a significant impact on inflation, but inflation for food and services was higher. If activity in the oil sector continues with the OPEC+ supply cut decision, inflation will slow down. In other words, the central bank will continue to monitor inflation as a key theme.

Today’s employment figures were close to estimates, but also confirmed a slowdown.

With markets closed and the data still lacking influence, the fact that it didn’t miss expectations for a decline earlier in the week could provide a slightly more positive outlook for the dollar.