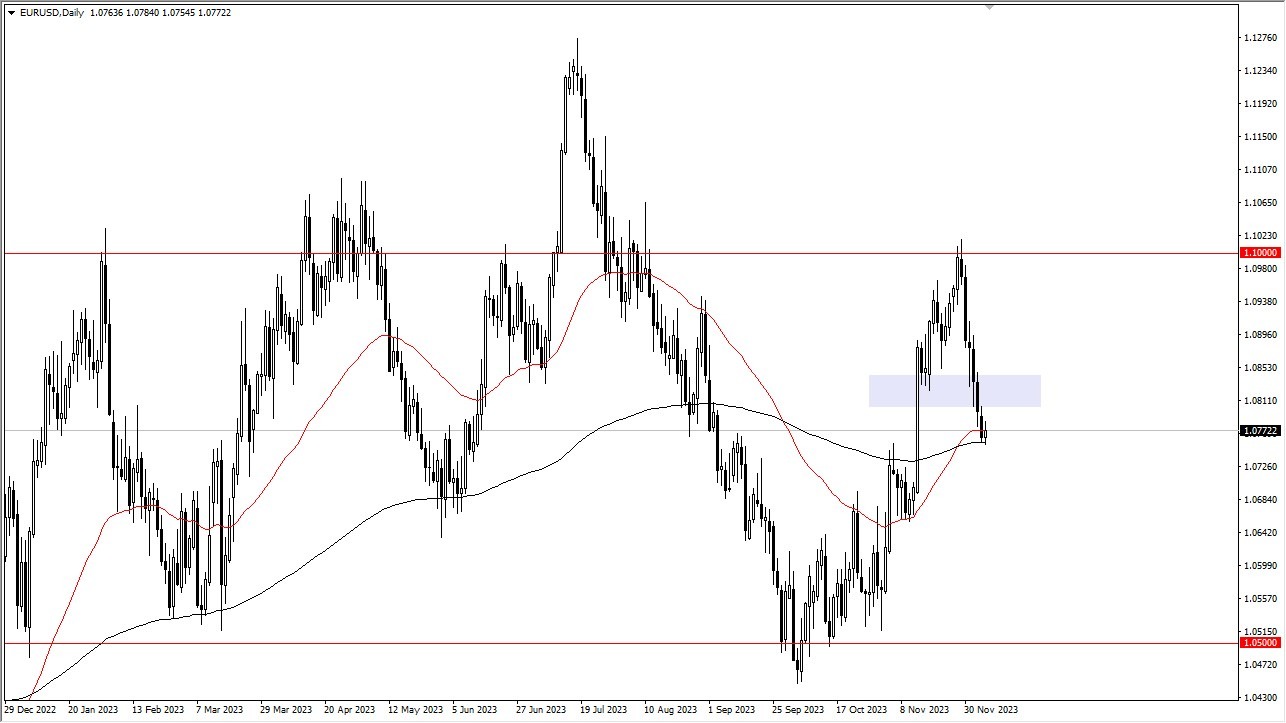

The Euro went back and forth during Thursday’s session, focusing on the 200-day EMA, an indicator that people sometimes focus on. At the same time, the market found itself testing the 1.0750 level, which had previously led to significant price volatility. Taking all factors into account, this situation highlights the situation where the Euro is preparing for a consolidation mode, which is waiting for an improvement in the US bond markets. Interest rates have played an important role in currency markets in recent times as traders discern the Federal Reserve’s stance on monetary policy – whether it will ease or maintain a more conservative approach.

Our recommended forex brokers in the region

Also, the recent decline in interest rates may indicate market expectations of an impending economic downturn, which tends to promote the safe-haven status of the US dollar. This dynamic manifests itself in increased demand for US bonds, which subsequently leads to lower yields and higher demand for the US dollar.

Further complicating the situation is the influx of capital into Europe, which is struggling with the problems of the Great Recession. Overall, prevailing landscape traders face short-term rallies, although support should remain in the intervention area. It’s worth noting that next Friday’s session will be important, as employment data could influence the central bank’s course of action, or at least the perception of what it may or may not do. The market will continue to ask a lot of questions about the EU, which will favor the US dollar. Additionally, if the world slips into a major recession, the US dollar is usually a safe haven for traders.

Ultimately, the Euro is going through a challenging environment right now and the 1.0850 level is one to watch as it struggles with various factors. A break of this level could indicate an upward trend, although the current momentum is insufficient to facilitate such a move. It’s conceivable that a significantly weaker employment report could give the markets the momentum they need to return to volatility and make this market move very quickly. However, as we approach the end of the year, this could mean a decrease in volume, making markets difficult to predict.

“Award-winning beer geek. Extreme coffeeaholic. Introvert. Avid travel specialist. Hipster-friendly communicator.”