© Reuters.

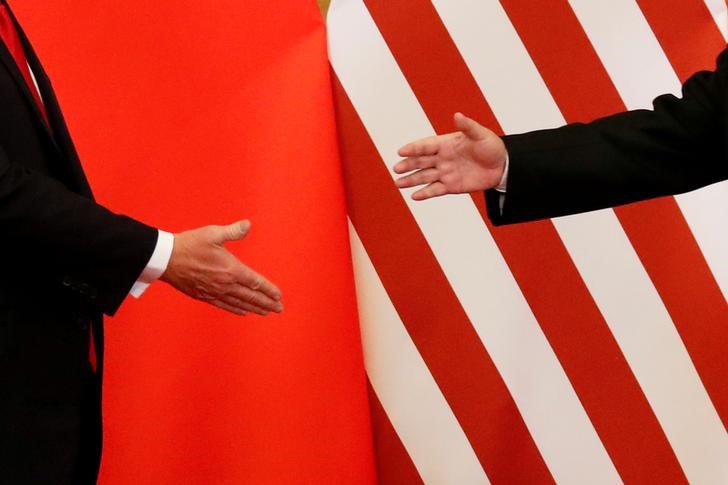

© Reuters. Investing.com – A former U.S. Treasury official questioned the reliability of stock data from the world’s second-largest economy after the U.S., China.

Former Treasury official Brad Chester said half of China’s currency reserves are “hidden,” a situation that adds risks to the global economy in the future.

China reported in its latest disclosure that foreign assets were valued at $3.12 trillion last December, but Setcher said foreign exchange reserves were actually $6 trillion.

“China is so big that the way it manages its economy and currency is so important to the world,” he wrote in his review. “However, over time, the way it manages its currency and foreign exchange reserves has become less transparent – creating new types of risks for the global economy,” he continued.

One of the sisters’ most important observations is that the ten years between 2002 and 2012 saw a violent increase in China’s foreign exchange reserves as the Chinese central bank bought dollar assets to maintain the yuan’s low value and stimulate exports. It has stopped since 2012 till now, although the growth of trade surplus has not stopped.

Setcher, former Deputy Assistant Secretary of the Treasury for International Economic Analysis and Senior Fellow for International Economics at the Council on Foreign Relations, explains:

“Just as there are ‘shadow banks’ in China—financial institutions that act like banks and take risks that banks would normally take but are not regulated like banks—China has so-called ‘shadow reserves.’ The market now appears on the balance sheet of the People’s Bank of China.

China’s state-run banking system is the main way Beijing hides its reserves, Setzer said. These include state commercial lenders such as Bank of China, Industrial and Commercial Bank of China or ICBC, China Construction Bank and Agricultural Bank, as well as policy banks such as China Development Bank and Export-Import Bank. Bank of China.

The report was published in the Insider newspaper, and Chinese authorities did not respond to inquiries shared by Setcher in the report.

“The sheer volume of China’s reserves carries enormous weight in financial markets and represents a risk,” Setzer asserted.

He explained his concerns: “China’s previous agency bonds — like those of Freddie Mac and Fannie Mae — helped trigger the 2008 financial crisis, driving investors toward riskier mortgage-backed securities.”

“China’s lack of transparency is kind of a problem for the world,” he said. “China is so structurally central to the global economy that anything, visible or invisible, will ultimately have a huge impact on the rest of the world.”

Investing gives you a free seminar on the inflation and inflation data that governs the movement of the US economy, and whose release can have a huge impact on the dollar, stocks and the Fed’s decision.

Analyst, Keith Abu Hilal, shares with us his most important interpretations and predictions on inflation data in the markets and beyond, and how to trade them successfully.

Seats are limited..To join: Click here

“Award-winning beer geek. Extreme coffeeaholic. Introvert. Avid travel specialist. Hipster-friendly communicator.”